SUSTAINABILITY AT YOUR FINGERTIPS

ESG Lab gives you unique real-time insights on ESG exposure and challenges which may affect your business and investments.

ESG Lab gives you unique real-time insights on ESG exposure and challenges which may affect your business and investments.

Traditional ESG ratings are incomplete, unstructured pictures of the past. With a very low update frequency and from an inside-out perspective, they are unfit to meet real-world challenges of ESG investing.

Most ESG scores provided by established rating agencies are updated once a year. Therefore, investors may not recognize ESG risks for up to 12 months after they occurred. Our news- based ESG scores complement these ratings with a real-time component.

Established rating providers only cover large public companies. Data sources for smaller and private companies are limited. Our ontology comprises more than 50,000 companies both private and public. If there is news coverage, we can generate a score.

For established ESG ratings, it is often hard to trace the reason for a specific score. Scores of different providers often show little correlation. In our news-based approach, you can drill down to the specific news articles in which ESG relevant events were detected.

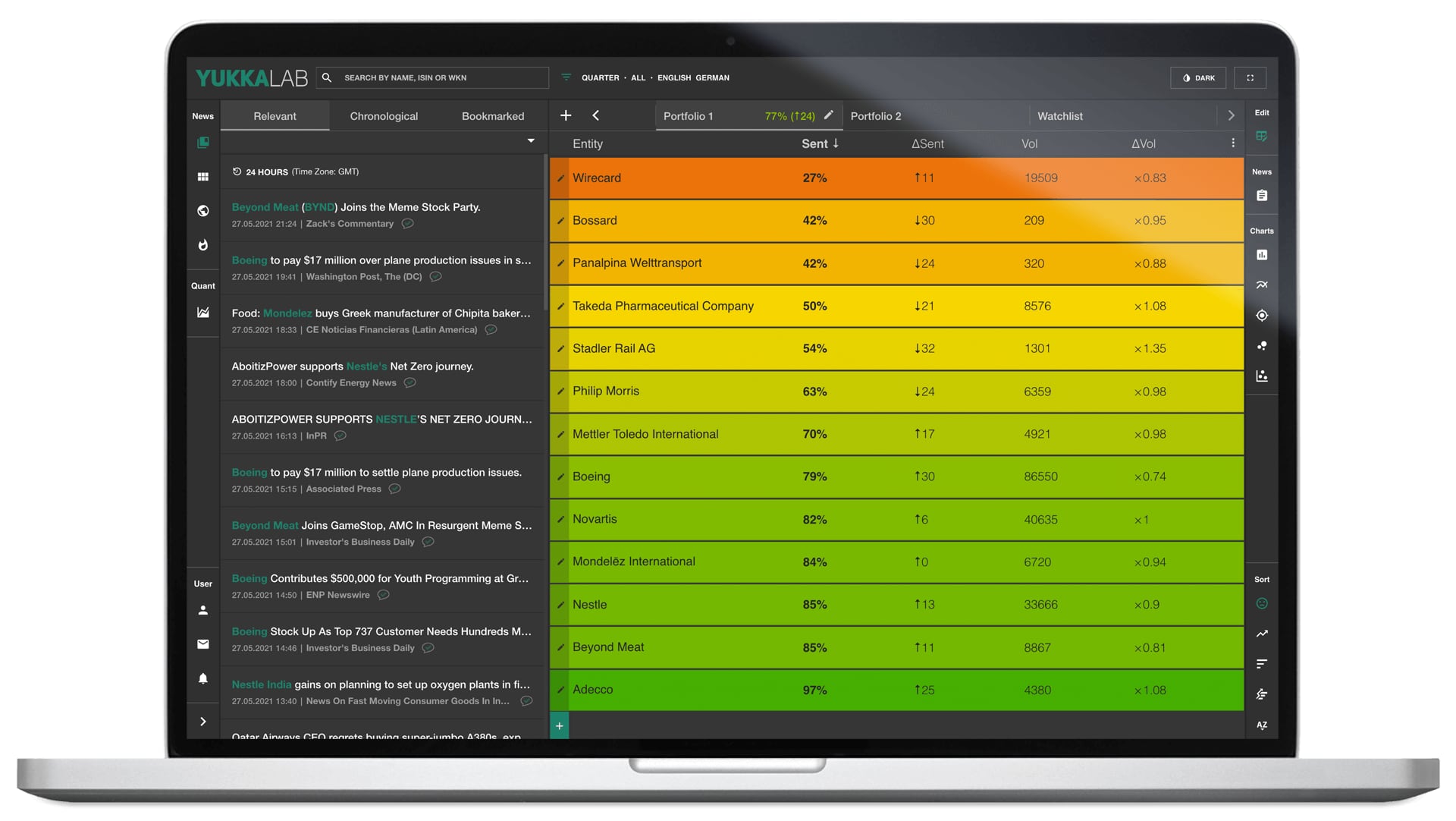

Monitor the ESG performance of your portfolio

Identify ESG risks in your supply chain

Discover promising sustainable companies

The Sustainable Finance Disclosure Regulation (SFDR) by the EU requires financial market participants to disclose detailed information about the environmental impact of their financial products.

A news-based ESG monitoring can be part of your strategy to achieve SFDR compliance and to have your funds certified as light green (article 8) or dark green (article 9) funds.

Established rating providers only cover large public companies. Data sources for smaller and private companies are limited. Our ontology comprises more than 50,000 companies both private and public. If there is news coverage, we can generate a score.

Based on our event tracking we calculate environmental, social and governance scores for all companies and aggregate them to an ESG score (including positive and negative events) as well as an ESG risk score (only highlighting negative events). Scores are based on the news events in the last three months and are updated in real-time.

Unique news trend overview

Better investment decisions

Actionable risk signals

Custom analytics integration