Next-level risk management

The COVID Pandemic and the Ukraine Crisis have shown that the world spins faster than structured data can reflect, making them a picture of the past.

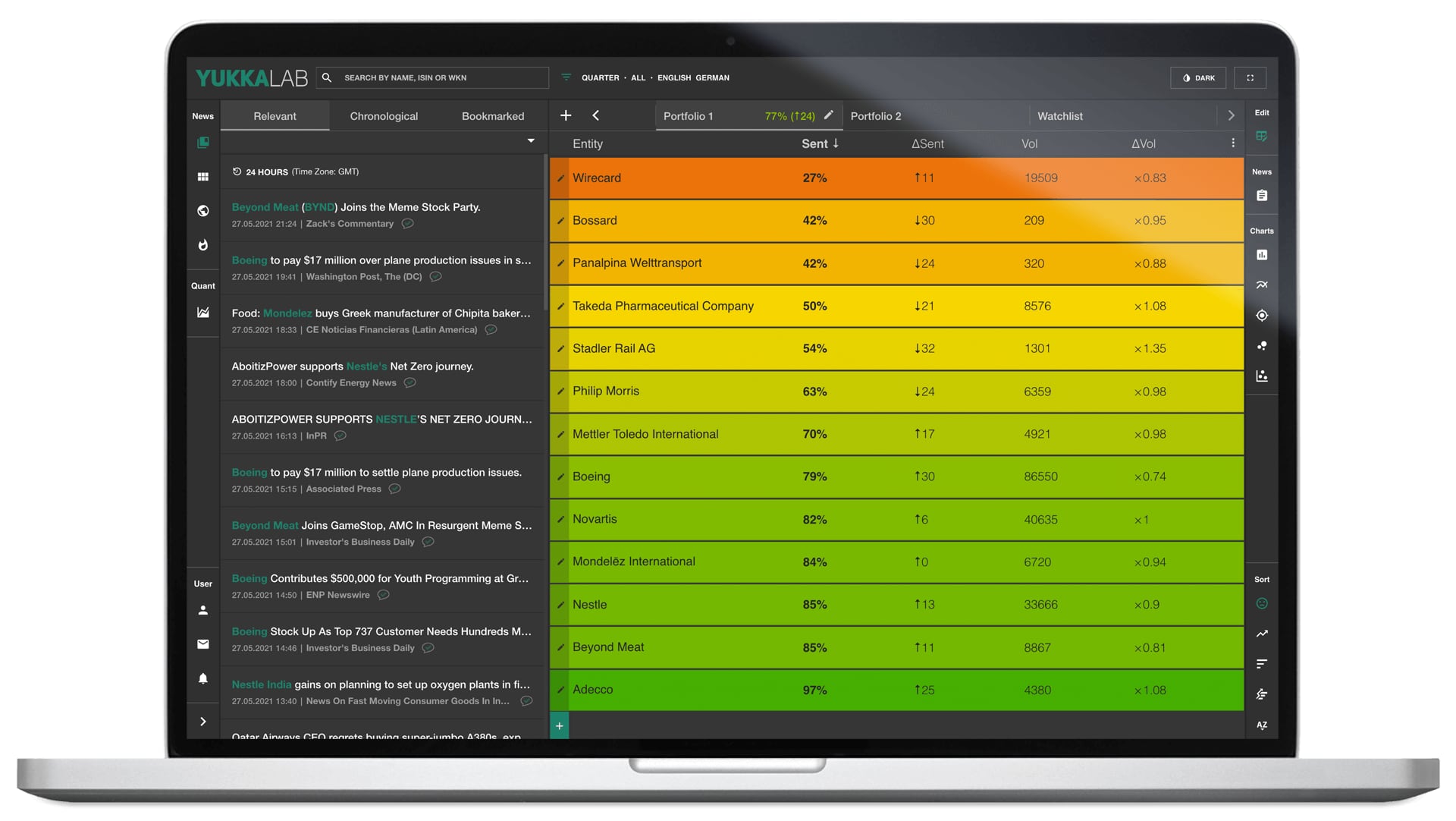

With YUKKA Lab`s real-time risk scores based on unstructured news data, we are about to change that and propel your risk management to the next level.