MAKING NEWS MEASURABLE

Real-Time ESG Controversy Screening at Scale

GET A DEMO (STOP REACTING & START ACTING)

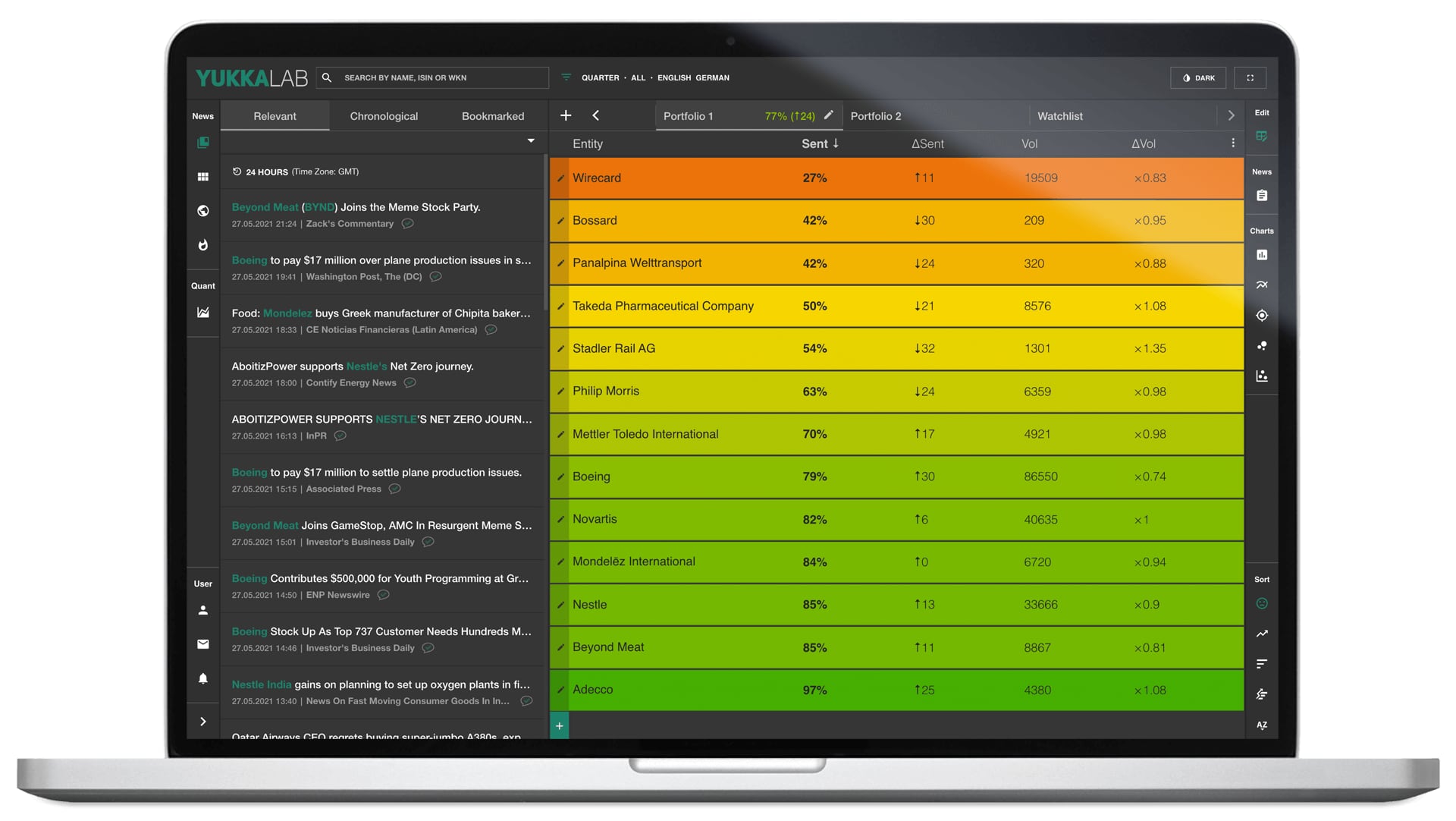

Turn NEWS Data into scores & signals

YUKKA Lab is the leading news signals company for finance, insurance & consulting industries.

We give our clients actionable information advantages, empowering them to outperform their competition through unique real-time news insights.

Screen the entire news landscape in realtime

Detect correlations & outliers with AI engine

Speed up analysis and boost performances

NEWS-BASED PREDICTIONS

WITH AN UNRIVALLED LEVEL OF ACCURACY

Our Augmented Language Intelligence Engine processes news data like a human mind but with the endless energy of a machine. Like an assistant, the engine will read all news and tell you what companies, clients and topics to give a good look at.

EMPOWER YOUR EXPERTISE

Empower your expertise with unique news analytics and trend signals to make better informed decisions: We analyse more than 700.000 news articles per day from +150k news sources and translate them into scores and signals for next-level risk management, ESG, sales, communication and investment businesses.

Save

time

YUKKA LAB Interprets the increasing flood of financial news – finding the most important information and providing neutral trend analyses fully automated and in real-time.

keep

TRACK

Be the first to detect and make use of relevant sentiments. Get your overview in an intuitive cockpit right at your fingertips.

Take

action

Increase your performance with our solution that offers the most comprehensive and reliable indicators of market sentiment and trend shifts.

Stay

up to date

Smart, fast and self-learning: State-of-the-art NLP, machine & deep learning combined with data mining. Augmented Language Intelligence at its best.

THIS IS HOW we do it.

(TEXT TBD) Automated Opinion Mining relies on several Artificial Intelligence techniques such as Machine Learning and state-of-the-art Neural Networks (Deep Learning).

SEMANTIC ANALYSIS

These techniques allow for the automated discovery of the sentiments and the strategic knowledge contained within financial news. Natural Language Processing (NLP), which is….

SENTIMENT ANALYSIS

offers the possibility to track the mood of the public about a particular company or topic, influenced by published media information.

YUKKA AI & ML neural networks

+150.000 news resources

+12 years of historical scores

+75,000 entities preloaded

MORE THAN USEFUL:

some of our MOST WANTED Use cases.

INVESTMENT OFFICE

- Unbiased Universe Construction

- Portfolio Optimization

- Equity Signals

- FX Hedging Signals

ESG COMPLIANCE

- Real-time news based ESG Scores

- Drill-down on impact news

- Highlighting of relevant events

- Outside-in perspective

RISK MANAGEMENT

The Covid Pandemic has shown that the world spins faster than structured data can reflect it, making them a picture of the past. With YUKKA Lab`s real-time risk scores based on unstructured news data, we are about to change that and propel your risk management to the next level.

- Credit Migration Prediction

- Customized Risk S.cores

- Real-time news-based Alerts

- Counterparty Monitoring

SUPPLY CHAIN MANAGEMENT

The new supply chain act “LkSG” is adding a new dimension of complexity to companies’ compliance management in Germany. Comply with central requirements of the LkSG law with our solution that 24/7 screens the news and automatically evaluates all relevant risks along your supply chain.

- Real-time news based ESG Scores

- Drill-down on impact news

- Highlighting of relevant events

- Outside-in perspective

it runs in the family:

meet the labs.

YOUR CUSTOMIZED COCKPITS

Our family of analytics tools put the YUKKA engine in a wide rage of use cases, offering perfectly customized cockpits for your specific tasks.

- Investment Analysis

- Risk Management

- ESG % LKSG Compliance

- Communication and Reputation Management

- Customized use cases

PRELOADED WITH ADVANTAGE

Empower your expertise with unique news analytics and trend signals to make better informed decisions and as an organization gain an edge over your competition.

- Faster information access

- Precise decision preparation

- Directly actionable insights

DON’T LISTEN TO US.

listen to our clients.

“The classic ESG indicators lag behind today's fast-moving, complex reality and display the past. Through YUKKA Lab´s unique AI we can provide real-time, news-based ESG scores along with the underlying news to our clients, so they can make faster and better investment decisions.”

Daniel Andemeskel, Head of Innovation Management der Universal-Investment Group

“20 years ago, a very senior Private Banker told us in a training for future private bankers „ private banking is all about emotions“. At the time, I was not exactly sure if I understood what he meant. In the meantime, I guess I figured it out. Empathy allows us to really understand our clients and this understanding helps us to find the best solution. The sentiment analysis from YukkaLab bridges the need for empathy to scalability. It provides the user with near to real-time information about current sentiments in financial markets - allowing the user to assess how clients might feel and therefore reach out in a pro-active manner”

Matthias Plattner, Technologist

“Thanks to YUKKA Lab, one is able to benefit from the unemotional evaluation of financial news and invest accordingly. It is a matter of recognizing early on when the huge turning points are reached in the market and to limit loss-making periods. All existing systems, robo advisor and algorithms mainly base their investment decisions on historic data sets. Here we are talking about real time analysis and news evaluation. In our opinion, this is an important game changer.”

Steffen Bauke, CEO, Belvoir Capital AG

we are all about news.

HERE ARE SOME news about us.