Our Augmented News Intelligence Engine processes news data like a human mind but with the endless energy of a machine. Like an assistant, our engine will read all news and tell you what companies, clients and topics to look at based on outlying news presence and events. Equipping your experts with unique news analytics and trend signals to make better informed decisions and as an organization gain an edge over your competition.

NewsLab

Unique news trend overview

YUKKA Lab measures the media presence of every company, industry and country in real-time, surfacing trends, unveiling the events that drive them as well as giving you access to the underlying online and licensed full text articles:

Monitor over 75k public & private companies in real-time

Get access to licensed full text articles & over two years of history

Detect outliers based on news volume & sentiment trend changes

Make better decisions based on intelligent news research

RiskLab

Next-level risk management

The Covid Pandemic has shown that the world spins faster than structured data can reflect it, making them a picture of the past. With YUKKA Lab`s real-time risk scores based on unstructured news data, we are about to change that and propel your risk management to the next level:

Structured risk monitoring of all counterparties & clients

News based risk boiled down to a single score

Customized risk scores for your business

Alerts for significant events & developments

Prediction models for upcoming risk & rating changes

ESGLab

Real-time news based ESG Scores

Track and monitor the impact of your investments, supply chain and business partnerships in real-time with our news based ESG scores and the underlying impact news. With over 100 relevant ESG events, YUKKA Lab screens the global news in real-time to provide an outside-in perspective on companies’ sustainability impact:

Real-time news based ESG scores

Customizable Scoring Engine with +100 ESG events

Complement existing ratings with our news based ESG scores

Discover events & underlying news behind the score

LKSGLab

Evaluate supply chain risks

The new supply chain act “LkSG” is adding a new dimension of complexity to companies’ compliance management in Germany. Comply with central requirements of the LkSG law with our solution that 24/7 screens the news and automatically evaluates all relevant risks along your supply chain.

Gather insights over your supply chain

Manage your portfolios

Comply with LkSG

Save time, money and paperwork

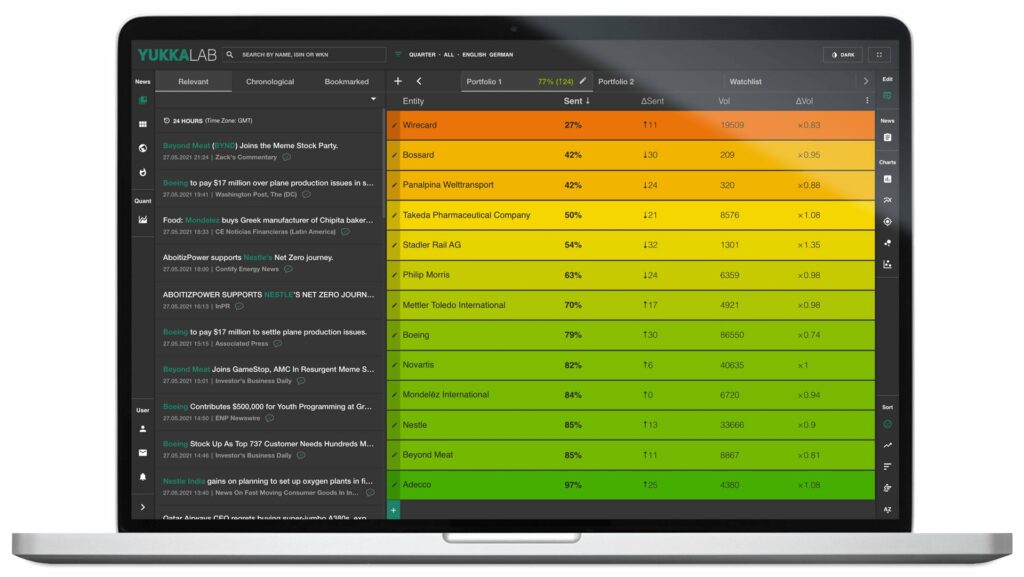

InvestLab

Better investment decisions

Get a more complete picture of the market and add real-time news sentiment analytics as an additional pillar to your investment approach thereby enhancing returns and improving risk characteristics. Understand the events that drive media coverage and performance of your investments and get an edge on the market by using YUKKA Lab`s unique real-time sentiment analytics to differentiate your investment approach. Our algorithms use cutting edge NLP and Deep Learning techniques to extract sentiment scores and events for each asset.

Stay on top of trend changes in market sentiment & significant events

Detect trend changes in market sentiment based on the news

Understand price shifts & discover the underlying events that drive the news

Integrate a new source of alpha for quantitative investment models

RestAPI

Unleash the power of news data for your business

Get the data you need through our REST API to enhance your systems and models. Through the API the full range of analytics, scores and signals across the use cases of Risk, ESG and Investment are available. The API is based on a documented REST interface, which allows integration via standard HTTP requests. Providing high flexibility as requests can be made from within web pages, mobile applications or backend systems. A scalable server cluster ensures high availability and responsiveness of the API.

YUKKA Lab possesses an archive with 15-years of labelled articles from licensed and public news sources:

Over 1 bln articles analysed and archived

75k public and private companies tracked

150 business, risk and ESG events intelligently detected

150k global news sources monitored