02 Aug News & Trend Lab insights: Facebook and Twitter plummet, is Snap Inc. next in line?

A forecast based on current sentiments in the YUKKA Lab News Lab.

It has been a difficult last week for tech and software sectors with both Facebook (FB) and Twitter (TWR) loosing over 20% of their market cap even though EPS (earnings per share) have met (Twitter) or even excelled (Facebook) analyst estimates. The main reason for this loss in share value is similar in both cases but of different origin: user growth has heavily declined in Q2 of 2018. Twitter is finally going after all those fake accounts and accounts of violent extremist groups. Although this creates a healthier image and community on the social network, which certainly everyone approves of, it at the same time also hurts user numbers. In Facebook’s case, the decline can be explained by the impacts of the Facebook-Cambridge Analytica data scandal and that Facebook is slowly hitting a wall in terms of market saturation.

Comparing these outcomes with the sentiment change in our News Lab we can see that in both the case of Facebook (Figure 1) and Twitter (Figure 2) the news sentiment found itself to be in a slight downwards trend over the past month although both hit a 2-week sentiment high on the 23rd (Facebook) and 24th (Twitter) of July. Just after though Facebook’s sentiment went down again on the 24th of July followed by the negative sentiment change of Twitter just one day after, on the 25th. These sentiment turns indicated a negative forecast which could be linked to the upcoming earning releases of Facebook on the 25th and the one of Twitter on the 27th which meant that investors using the YUKKA Lab cockpit had enough time to reconsider investment volumes before the “meltdowns” after the official earnings release.

Figure 1: YUKKA Lab Facebook sentiment analysis (30.6.18-30.7.18)

Figure 2: YUKKA Lab Twitter sentiment analysis (30.6.18-30.7.18)

Snap Inc. (SNAP) is the last big social media company who has yet to release their earnings in the second quarter, which will happen in just under a week on the 7th of August. Investors are skeptical if the fate of Snap Inc.’s bigger rivals is going to repeat itself for them or if the rather young company was able to exceed analyst expectations in Q2.

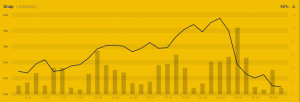

Again, we shall take a look at the sentiment benchmark in the News Lab (Figure 3) and compare it with the previously mentioned ones of Facebook and Twitter. It immediately becomes evident that the parent organization of Snapchat has suffered an even bigger hit during the time span of the 23rd and 27th of July than its rivals with a sentiment drawdown of almost 8%. This decrease shows overall uncertainty over the value of the stock and at this point of time also over the upcoming earnings release especially as this previously mentioned drawdown has yet to fully translate itself in the actual share price of the company which only dropped about 4%.

Figure 3: YUKKA Lab Snap Inc. sentiment analysis (31.6.18-31.7.18)

Sentiment development of Technology as an industry (Figure 4) is experiencing a downward trend as well. This obviously is affected by not only the individual sentiments of Facebook, Twitter and Snap Inc. but also by over 100 other hard-, and software giants around the globe which are not doing too well in the last days either.

Figure 4: YUKKA Lab Tech industry sentiment analysis (30.6.18-30.7.18)

Sentiment analysis of all Snap Inc. itself, competitors and the industry as a whole show that dark clouds lie ahead of the Snapchat parent before the earnings release next week. Forecasts based on sentiment analysis, again and again, prove to be a reliant and effective way of forecasting short-term share prices and in this case, we can also base our assumptions on recent developments and correct forecast outcomes of main competitors and the industry as a whole.

Snap Inc. is therefore forecasted to drop in value after the official earnings have been released although this loss is definitely not going to be as severe as the ones we have seen for Facebook and Twitter last week.

We look forward to the highly anticipated earnings release of Snap Inc. on August 7th and continue to keep sentiment changes in line of sight in order to see if this forecast can indeed prove itself to be correct and could help to make an appropriate estimate of what will happen to the share price, or if the sentiment drawdown might even be linked to a negative event before the earnings release and not to the earnings release itself. We will also continue to observe these changes so sit tight for another article on this topic which most likely will be released next week after the earnings release of Snap Inc.!

In the meantime, feel free to write me and let me know if you agree with this article and forecast or why you might think that Snap Inc. could even perform better than both investor and analyst expectations! vba@yukkalab.de

—-

This story was provided by Valentin Back, Finance & Analytics Summer Intern at YUKKA Lab and Student at Warwick Business School.